Tickmill, established in 2014, is a global forex and CFD broker recognized for its tight spreads, fast trade execution, and strong regulatory framework. It caters to both beginners and experienced traders by offering a range of account types, competitive trading fees, and access to industry-leading platforms, including Tickmill MT4 and Tickmill MT5.

The broker stands out for its transparent trading conditions and is regulated by the FCA, which enhances its credibility. With a solid presence across Europe, Asia, and Africa, Tickmill has built a reliable reputation among traders worldwide. In this Tickmill review, we’ll cover all the essential details to help you decide whether Tickmill is the right broker for your trading journey.

| Headquarters | 3, F28-F29 Eden Plaza, Eden Island, Mahe, Seychelles |

| Established | 2014 |

| Regulation | FCA, FSA, CySEC |

| Platforms | MT4, MT5, WebTrader, Tickmill Trader |

| Instruments | 60+ Forex pairs, Commodities (Gold, Oil, Silver), Indices, Bonds, Stock CFDs, Cryptocurrencies |

| Minimum Deposit | $100 |

| Deposit Methods | Bank wire, credit card, crypto, debit card, FasaPay, NETELLER, Skrill, STICPAY, UnionPay, and WebMoney |

| Mobile Trading | Yes |

| Web Trading | Yes |

| Minimum Trade Size | 1 micro lot (1,000) |

| Maximum Leverage | 1:1000 |

| ECN | Yes |

| Robots | No |

| Scalping | Yes |

| Customer Support | 24/5 |

Account Types

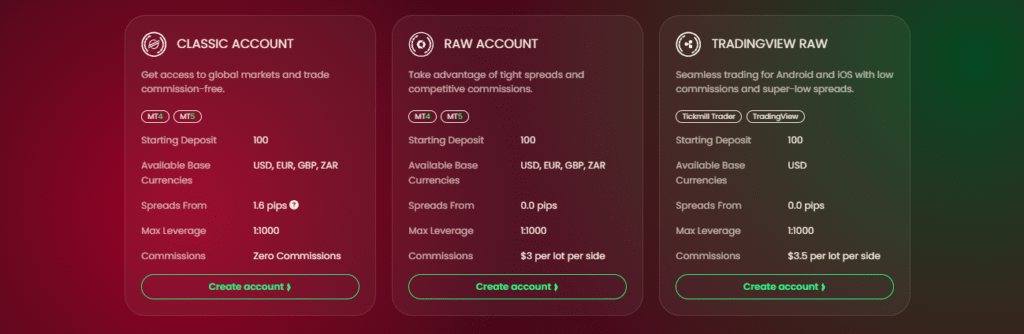

Tickmill provides traders with three main account types: Classic, Raw, and TradingView Raw. Each account supports all MetaTrader platforms, offers leverage up to 1:1000 (known as Tickmill leverage), and has a minimum lot size of 0.01. Traders can choose from several base currencies (USD, EUR, GBP, ZAR) and open swap-free Islamic accounts on any account type. For practice, a Tickmill demo account is also available, giving new users the chance to test strategies in a risk-free environment.

Classic Account

The Classic Account is a great choice for beginners or those who prefer trading without commissions. It requires just a $100 minimum deposit and offers spreads starting from 1.6 pips. With no added commission charges and full support for all strategies, it provides an easy entry point into forex and CFD trading.

Raw Account

Designed for traders who want tighter spreads, the Raw Account also requires a $100 deposit. Spreads begin from 0.0 pips, with a fixed commission of $3 per side per lot. This account is especially appealing to scalpers and intraday traders, as it combines ECN-style pricing with transparent costs and fast execution.

TradingView Raw Account

This account is tailored for those who prefer to trade directly from TradingView. It mirrors the Raw Account setup, offering spreads from 0.0 pips and commissions starting at $3.50 per side, per lot. It’s ideal for traders who rely heavily on advanced charting and want seamless execution within the TradingView platform.

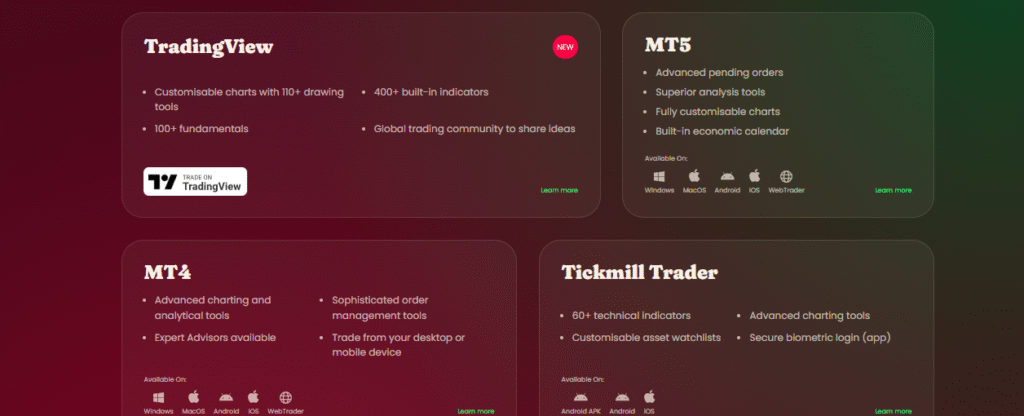

Trading Platforms & Tools

Tickmill ensures traders have multiple options to access the markets, whether through desktop, web, or mobile. The broker supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), integration with TradingView, and its own proprietary Tickmill Trader platform.

MetaTrader 4 & 5

Both MT4 and MT5 are available across devices and offer reliability, speed, and customization. Traders benefit from one-click execution, automated trading through Expert Advisors (EAs), and a wide selection of charting tools. MT5 further enhances the experience with improved order management, additional indicators, and access to more asset classes.

TradingView Integration

Tickmill’s connection to TradingView lets traders place orders directly from TradingView charts. This is particularly useful for technical traders who depend on visual analysis. The integration ensures real-time pricing, rapid execution, and smooth account synchronization.

Tickmill Trader

For those who prefer simplicity, Tickmill offers its own Tickmill Trader platform for web and mobile. While it may not match the advanced features of MT5 or TradingView, it delivers a straightforward, secure, and user-friendly experience for trading on the go.

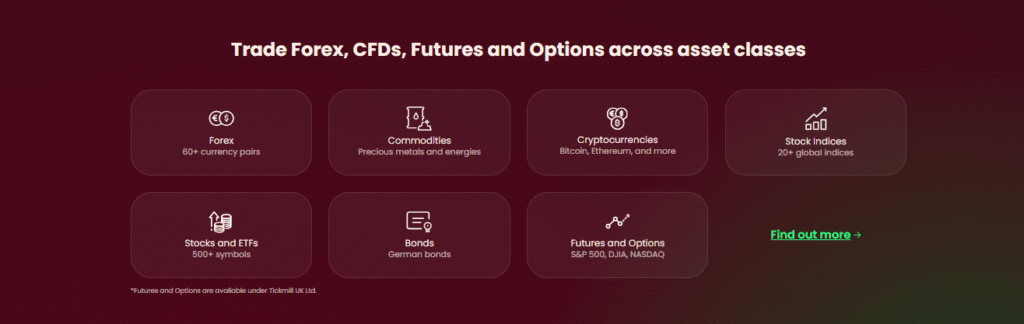

Tradable Instruments

Tickmill gives traders access to over 180+ instruments across multiple asset classes, covering forex, indices, commodities, and bonds. This wide range ensures flexibility for traders who want to diversify their strategies.

-

Forex: More than 60 currency pairs (majors, minors, and exotics) are available, with low spreads and fast execution—particularly attractive for scalpers and day traders.

-

Indices: Major global indices such as US30, GER40, UK100, and NASDAQ can be traded with competitive margin requirements and no requotes.

-

Commodities: Traders can access CFDs on gold, silver, crude oil, and natural gas—key markets for hedging against inflation or trading energy trends.

-

Bonds: Unlike many retail brokers, Tickmill offers CFDs on German and US government bonds. This unique feature allows traders to speculate on interest rate movements or hedge larger macro positions.

Deposits, Withdrawals & Fees

Deposits

Tickmill keeps funding simple and accessible. Most accounts require a minimum deposit of just $100, which is processed instantly within minutes. The broker does not charge any internal deposit fees, though traders should be aware that third-party payment providers or banks may apply charges. The low Tickmill minimum deposit is one of the features that makes the broker attractive to beginners.

Withdrawals

Withdrawals are straightforward and usually completed within one business day. Tickmill does not apply any internal withdrawal fees, but external charges may depend on your payment method or location. The process is designed to be quick, smooth, and transparent.

Fees

One of Tickmill’s strongest points is its clear and transparent pricing structure.

-

Classic Account: Commission-free, but spreads start from 1.6 pips.

-

Raw & TradingView Raw Accounts: Tight spreads from 0.0 pips, with a flat commission of $3–$3.50 per side per lot.

Tickmill also offers swap-free Islamic accounts on request. From time to time, traders may find promotions such as a Tickmill welcome bonus or no deposit bonus, though these offers vary by region and are usually time-limited.

Research & Education

Research Tools

Tickmill equips traders with multiple research resources to support informed decision-making:

-

Daily market analysis covering forex, indices, and commodities.

-

Economic calendars and technical outlooks from in-house analysts.

-

Weekly webinars and expert insights in multiple languages.

-

Autochartist integration for advanced pattern recognition.

-

A dedicated Trader Tools section, including calculators and sentiment indicators to gauge market trends.

Educational Material

The broker provides a solid library of educational resources for both new and advanced traders, including:

-

Video tutorials, eBooks, and guides on trading basics and strategies.

-

Interactive webinars covering trading psychology, risk management, and advanced topics.

-

Courses available in multiple languages to serve Tickmill’s global client base.

These materials are also useful for those exploring Tickmill copy trading, offering insights into strategies, risks, and signals.

Customer Support

Tickmill earns high marks for its responsive and multilingual customer support, available 24/5. Traders can connect via live chat, email, or phone, with support offered in English, Arabic, Spanish, Vietnamese, and many other languages—demonstrating the broker’s commitment to serving a truly global audience.

Live chat is the fastest option, typically connecting users to an agent within seconds. Support staff are knowledgeable, polite, and quick to assist with issues such as account setup, funding, platform use, or trading conditions. This reliable service adds a strong layer of trust and convenience for both new and experienced traders.