As you will find out in our FxPro Review, the company offers CFDs and spread betting on the Forex, futures, spot, share, spot, and spot metrics. They serve clients in over 150 countries around the world and offers multilingual 24/5 customer support.

FxPro stands out as one of the most recognizable names in the forex industry. Since their founding in 2006, they have executed over a quarter of a billion orders. Each second, they execute an average of 7000 orders. As one of the most recognizable names, FxPro has partnered with companies like McLaren and sponsor Yacht Club de Monaco. Today, FxPro is established as one of the most prominent best forex broker with clients from over 170 countries worldwide. They are one of the most well-regulated companies with a very high trust score.

Traders are offered access to six asset classes with Tier 1 capital, which exceeds 100 million euros. They’ve some of the fastest speeds in terms of execution. Keep in mind that approximately 77% of the traders on FxPro, lose money. FxPro is a true NDD (no dealing desk) type of brokerage firm. The latest information shows that most of the trades are executed at the quoted price, with less than 13% experiencing positive slippage and about 12.5% experiencing negative slippage.

FxPro Review 2025 Quick Summary

| 🏢 Headquarters | UK |

| 📆 Established | 2006 |

| 🗺️ Regulation | FCA, CySEC, FSCA and SCB |

| 🖥 Platforms | MT4, MT5, cTrader, FxPro Edge |

| 📉 Instruments | Forex and CFDs on 6 asset classes, with over than 260 instruments |

| 💳 Minimum Deposit | $100 |

| 💰 Deposit Methods | Debit, credit, and prepaid cards (Visa, Mastercard), Bank wire transfer, Paypal |

| 📱 Mobile Trading | Available |

| 🌍 Web Trading | Available |

| 💵Minimum Trade Size | 0.01 |

| 🎢 Maximum Leverage | 1: 500 |

| 🌍 ECN | Available |

| 🤖 Robots | Available |

| 🎯 Scalping | Allowed |

| ☎ Customer Support | 24/5 |

FxPro Review Regulation

FxPro is properly regulated in multiple jurisdictions by respected agencies. Here is a list of all the subsidiaries and the agencies that oversee them:

- FxPro UK Limited falls under the authority and regulation of the Financial Conduct Authority (FCA).

- FxPro Financial Services Ltd falls under the regulation and authority of the Cyprus Securities and Exchange Commission, CySEC.

- FxPro Financial Services Limited is regulated in South Africa by the Financial Sector Conduct Authority of South Africa.

- FxPro Global Markets Limited is regulated in the Bahamas by the Securities Commission of Bahamas.

Every one of these licenses is verifiable in the jurisdictions that we have indicated and can be confirmed by checking the numbers on each of these regulatory bodies’ websites.

To make sure that the clients are always protected, these are the additional measures in place.

- Segregation of the client funds from FxPro company funds. They are held in Barclays Bank, Royal Bank of Scotland, and Julius Baer.

- They offer negative balance protection

- They have auditing of their financial reports done by PWC

- FxPro Limited in the UK is registered to the Financial Services Compensation Scheme (FSCS)

- FxPro Financial Services Limited is registered to the Investor Compensation Fund (ICF)

You should know that FxPro does not accept clients from the following countries: Canada, Iran, and the USA.

FxPro Bonus for Deposits & Promotions

Modern regulations state that brokers are not allowed to give any bonuses or promotions. If you find some promotion on the internet claiming to be from FxPro, it is probably a scam trying to take you for your money.

Always make sure that if any promotion or offer is available, it is coming from the broker and not from other parties that cannot be trusted or verified.

FxPro Trading Fees

Generally, you will not be charged the following fees:

- Withdrawal fees

- Inactivity fees

- Deposit fees

When trading on FxPro, you will not be charged commissions, unless you are on the cTrader platform. The minimum deposit is $100. The general fees are standard for the market, with details of each account showing exactly how much you would have to pay.

FxPro Review: Withdrawal and Deposit Options

FxPro offers its clients several options to use when withdrawing or depositing money. If you want to deposit money into your account, you can use Neteller, Skrill, PayPal, Union Pay, credit cards, and debit cards.

They have a FxPro Wallet you can use to make your transactions much faster and even more reliable. The wallet is custom made just for FxPro and is used by clients to make sure that the fund transfers are fast and reliable in a way that they can understand.

Most of the deposits that they make are funded instantly within ten minutes. Withdrawals are processed within one working day. Most of the details are on the broker’s homepage to ensure that you transact with ease and without glitches.

To get the details of this, you should check out the FxPro client portal area.

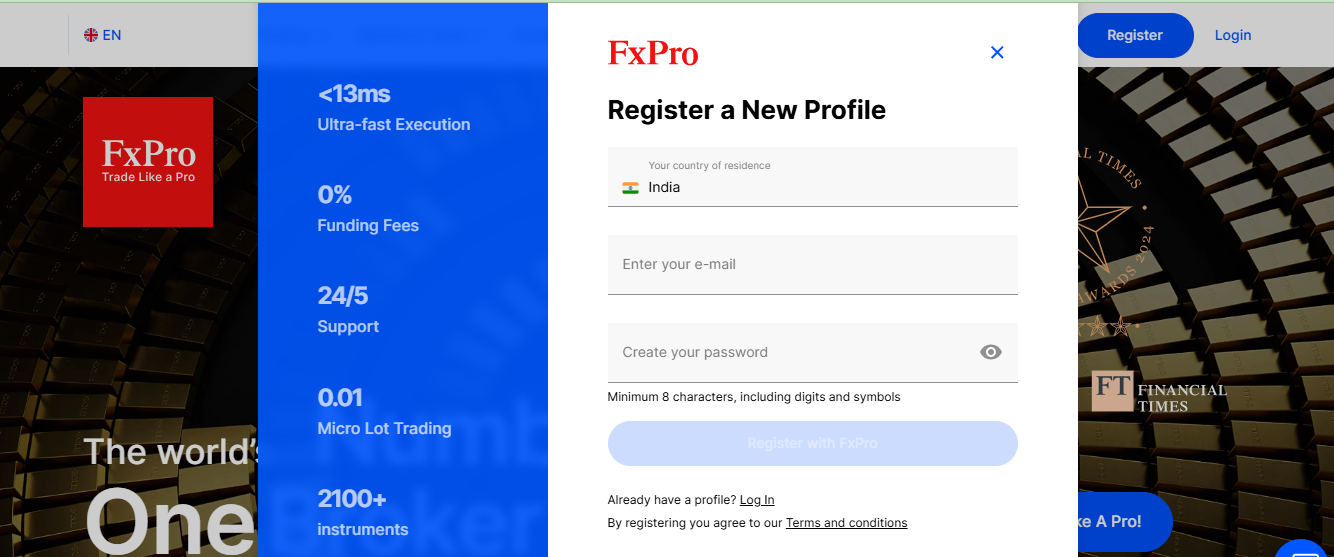

FxPro Account Opening

Opening an account on FxPro is relatively easy. The entire process is digital, allowing you to log in online and submit the credentials needed. You’ll go through a process that requires proof of identity and proof of address.

It would help if you were prepared to offer both in the form of a national ID card, passport, or other legal identification documents. As for the address, you can upload a recent bank statement, utility bill, or any other official documentation as specified. The thing you need to keep an eye on is that the documentation you send in for address proof contains the address. It has to be visible.

This is following the regulatory requirements that are now standard in the forex market. After you get through the preliminary information, you will be required to set up your account settings by opening MT4, MT5, cTrader, or the FxPro account type.

After you are given access to the FxPro client portal area, you will open either the demo account or the live account and start trading immediately.

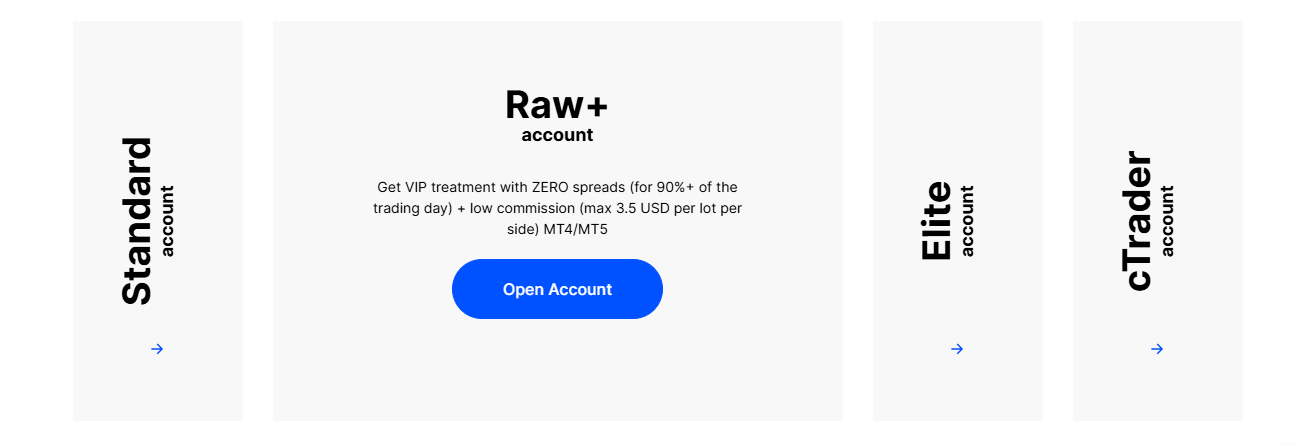

FxPro Review: Account Types

The account types you will get when you are on FxPro are wide and varied to ensure that you have the choices you need. That way, you can choose something that is within the budget you would like. The pricing model is different, but you will find that there is something for everyone.

There are three trading accounts to choose from:

Live Trading Account

Here, you will have the following features:

- Six asset classes that have over 250 tradable instruments ts

- You can use MT4, MT5, cTrader, and Edge.

- The deposit to start you off is recommended at $1000

- Retail clients can use a leverage of up to 1:30

Professional Trading Account

Here you will get:

- Higher leverage that is adjustable to levels that you can tolerate in terms of risk management

- Negative balance protection is offered, so you do not lose more money than you deposit

- The investor protections are not as widely varied as in the Live Trading Account

The next account is the top one of them all.

VIP Trading Account

The details you get for this are:

- This account is only used by NHW trading high volumes

- The access to VPS is not restricted at all

- The commission is lowered by 30% when trading on cTrader accounts

- There is a 30% discount on the market spreads

As all things go, this account is the one that would be best for most traders. However, with the details stating that the clients are only large volume, it is not very sustainable for those looking to trade smaller amounts.

Trading Platforms

- Over 50 indicators for use in technical analysis

- Charting tools

- Trading widgets that make it faster to switch from one function to the other

- Six types of charts

- A view of 15 timeframes, which is more than MT4

- A layout you can customize to fit your trading style or aesthetic.

To get more details about how it works, you can check out the demo on the website. It will allow you to look through and see what they offer and how they present it.

FxPro Customer Service Experience

You can reach a customer service assistant 24 hours a day for five days a week. You can reach them through live chat on the website, telephone (the numbers are provided on the site), or email. The faster way to get a response is through the Live Chat function.

The staff knows the answers to questions asked and will help you get answers to all your questions.

The General Experience

From what we can tell, the broker provides traders with competitive asset classes that make choosing easy. With more than 250 financial CFD instruments that cover all the classes, you can use the most commission-free trades with spreads and swaps payable.

The offering of platforms is also wide and varied. You will choose between MT4, MT5, cTrader.

All of the platforms are available for mobile, PC, and Web. Users are also getting tools like calculators, calendars, company earnings, and other research tools like Trading Central by FxPro.