The XM broker was founded in 2009 by a group of interbank dealers looking to expand the forex market’s services. In our XM review, we see that the company has transformed into a broker with many online assets. It has headquarters in the Republic of Cyprus and is registered under the name Trading Point of Financial Instruments Ltd.

XM Group (XM) is a group of regulated online brokers. Trading Point of Financial Instruments Ltd was established in 2009 and it is regulated by the Cyprus Securities and Exchange Commission (CySEC 120/10), Trading Point of Financial Instruments Pty Ltd was established in 2015 and it is regulated by the Australian Securities and Investments Commission (ASIC 443670) and XM Global Limited was established in 2017 and is regulated by the Financial Services Commission (000261/397).

XM Broker Review 2025 Quick Summary

| 🏢 Headquarters | Cyprus, Australia, Belize and Dubai |

| 📆 Established | 2009 |

| 🗺️ Regulation | ESMA, CySEC, ASIC, FSC and DFSA |

| 🖥 Platforms | MT4 and MT5 |

| 📉 Instruments | Instruments: Forex Trading, Cryptocurrencies, Stock CFDs, Turbo Stocks, Commodities, Equity Indices, Precious Metals, Energies and Shares. |

| 💳 Minimum Deposit | $5 |

| 💰 Deposit Methods | Multiple local payment methods available |

| 📱 Mobile Trading | Available |

| 🌍 Web Trading | Available |

| 💵Minimum Trade Size | 0.01 |

| 🎢 Maximum Leverage | Maximum Leverage: 1:1000 ((Note: “This leverage is not available to all the entities of the Group. The maximum leverage for clients registered under the EU regulated entity of the Group is 30:1”) |

| 🌍 ECN | Available |

| 🤖 Robots | Available |

| 🎯 Scalping | Allowed |

| ☎ Customer Support | 24/7 |

What We Like About XM

What XM Could Improve

- The trading platforms are limited to MT4, MT5, and Webtrader.

- It is not exactly marketed as a high-volume professional forex broker company.

Regulation

As we mentioned earlier, this company is heavily regulated in many jurisdictions in the world. Some of the most significant regulation agencies that oversee it are:

- The Cyprus Securities and Exchange Commission ( CySEC )

- The Belize Financial Services Commission (FSC)

- The Australian Securities and Investment Commission (ASIC).

- The Dubai Financial Services Authority (DFSA)

All of these regulatory agencies are from first-world countries with strong law enforcement measures in place. When trading with this broker, you will not have to worry about safety. We also found out during this XM review research, that the broker is more widely regulated.

They are registered in over 10 European countries, each with a different regulatory agency like the FSB, AMF, CONSOB, ACP, FIN, KNF, FI, and Europe’s MiFID. Each of these agencies oversees countries like Spain, Italy, Hungary, Poland, Netherlands, Italy, and Sweden.

There is no doubt that XM is one of the leading forex brokers on the planet. To offer additional investor protections, the broker also does the following:

- They have an investor compensation fund under the CySEC jurisdiction of up to €20,000

- Clients enjoy negative balance protection in any jurisdiction so that they never lose more than they deposit.

Trading Fees

Trading Real Stocks:

Clients outside Europe can trade real stocks on the XM Share account. The commission you pay is dependent on the market you are trading.

NOTE: These figures used are estimates used for benchmarking during the XM review compared with other brokers. Your experience may slightly differ, as the markets tend to change and fluctuate.

Withdrawal and Deposit Options

Account Opening

Account opening is quite easy and fully digital. All you need to do is make sure that you are giving the correct information. You will also have to be prepared to offer proof of identity and proof of address. Submit a copy of your ID, passport, or other official documentation that’s accepted as proof of identification. For the address, submit a bank statement or other official documents that detail where you live.

Submit the information and wait for approval. After approval, you can fund your account, log in to any of the XM trading platforms, and start trading. There is no limit on the number of XM demo accounts you can open. However, the number of XM live accounts you can open is limited to 10.

Using the same email address for all your additional accounts is always essential. This is so you can manage all the accounts from the same area in the client portal/Members Area. If you want to have a fresh start, you can open a new account with another email address, using the same credentials for identity and address.

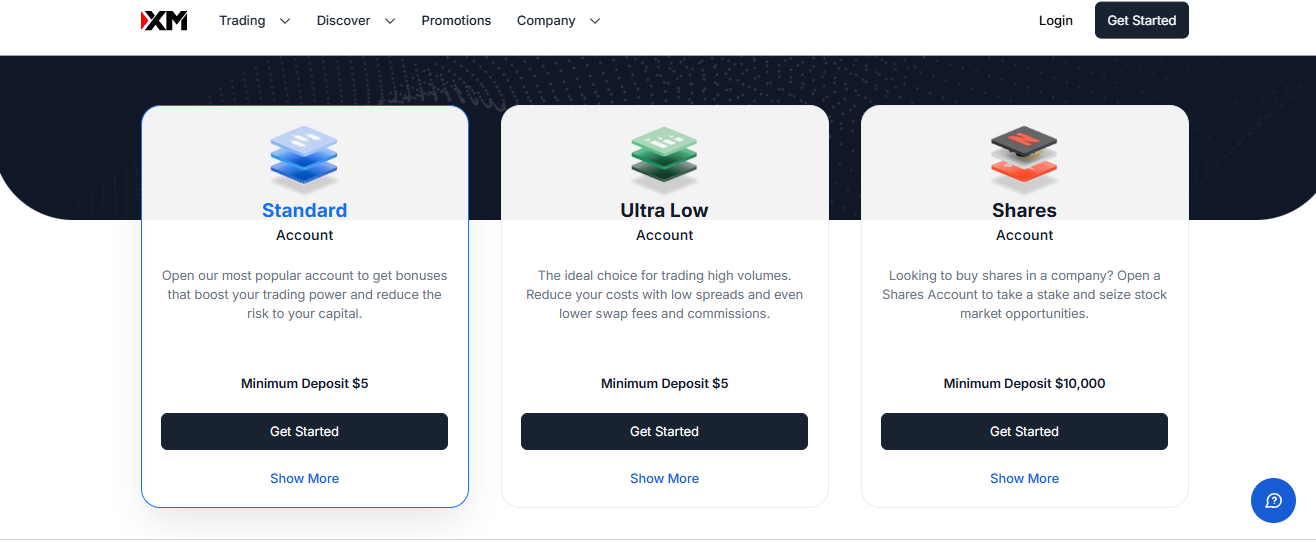

XM Account Types

There are four major account types, plus the XM demo account. To understand what XM account types can offer you, we are going to break them down. That way, you will match your ability, strategy, and budget to the right one.

Here are some of the best features our XM review found out about the accounts:

- You can trade both standard and micro-lots.

- There is unlimited access to expert advisor trading on MT4 and MT5.

- You can access technical analysis and free intra-day market updates.

- The execution speeds are the same on all accounts.

With a low and competitive minimum deposit of $5 across all of them, it is correct to say that anyone can open an account. As we mentioned earlier, XM account types are not designed to target high-volume traders. They are ideal for traders who do not stake too much or trade vast amounts.

XM Micro account is low-cost and easy to use. With a low XM minimum deposit of $5, it comes in as one of the cheapest accounts to open.

You can use the leverage of up to 1:1000, without commissions. You will pay broker fees with spreads. There is negative balance protection to ensure that you never lose more money than you deposit.

With the XM micro account, you can open up to 300 positions at the same time.

Key Details To Note About XM account Types

Trading Platforms

You will have the option of choosing between MT4 and MT5. The platforms are available on desktop, web, and mobile. XM MT4 is the most widely used, given that it is the platform with the highest number of users in the world.

You can get clear reports on fees on the desktop, customize your charts and workspaces to be how you like them, and get price alerts by setting notifications. The best part about the notifications is that they can help you stay away from the terminal and still be able to trade by knowing when to close or open positions.

On WebTrader, you will have access to the same functions that you will find on the desktop. The only difference is that you will not have to install the app if you access it from the web. On mobile, access the relevant XM server to get the best service. Both Mt4 and MT5 are available for download on iOS and Android devices.

- All the tradable instruments across all the asset classes

- One-click trading

- Spreads as low as 1 pip

- Full EA trading

- Technical analysis tools

- 50 indicators and charting tools

- 3 different chart types

MT4 is one of the world’s most reliable platforms, and it will not fail you here.

Additional Features

As always, value is gained from a broker when they can offer you more than the competition. I think that, in this regard, XM has proven itself to be more than enough. You can get additional tools that come from Avramis, among other features.

- River Indicator

- Ribbon Indicator

- Ichimoku Indicator

- Bollinger Bands Indicator

- ADX and PSAR Indicator

If you would like to use these tools, you will need to access the personal account manager.