Admiral Markets, founded in 2001, is one of the longest-standing forex brokers in the industry. With over two decades of experience, the company has built a reputation for reliability and consistency. In our view, brokers that remain in the market for so many years typically do so because they deliver on their promises and earn trader trust.

In this comprehensive Admiral Markets review, we will highlight what makes the broker stand out, why it has maintained such strong longevity, and whether it is the right choice for your trading journey. Admiral Markets is regulated by two tier-1 and two tier-2 authorities, providing traders with a safe and well-protected trading environment.

Over the years, Admiral Markets has refined its offering by providing advanced analytical tools, seamless platform integrations, and features designed to improve trading accuracy. Their education services are among the best in the industry, covering a wide range of topics in detail to ensure traders of all levels gain valuable knowledge.

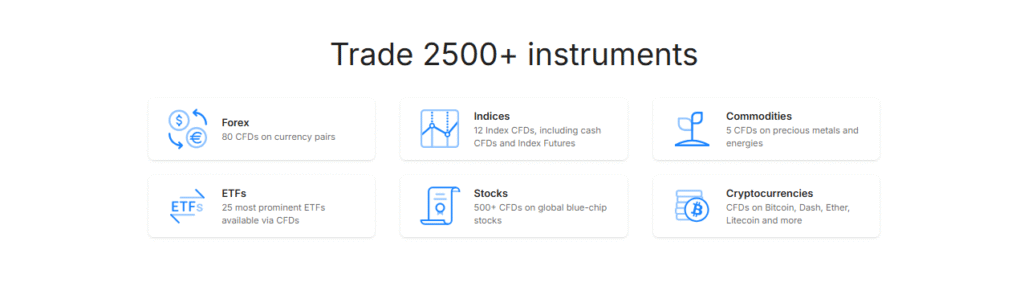

With a vast selection of 4,000+ tradable instruments, Admiral Markets also supports portfolio diversification, giving traders opportunities across forex, indices, commodities, shares, ETFs, and more.

| Headquarters | UK |

| Established | 2001 |

| Regulation | ASIC, FCA, CySEC, EFSA |

| Platforms | MT4 and MT5 |

| Instruments | Metals and currencies, CFDs trading |

| Minimum Deposit | 100$ |

| Deposit Methods | Bank Wire,VISA,MasterCard,iBank & BankLink,iDEAL,Klarna,Neteller |

| Mobile Trading | Available |

| Web Trading | Available |

| Minimum Trade Size | 0.01 |

| Maximum Leverage | 1:30 |

| ECN | Available |

| Robots | Available |

| Scalping | Allowed |

| Customer Support | 24/5 |

Fees, Spreads, and Commissions

Admirals maintains a competitive and transparent pricing model across all account types. Spreads start from 0.0 pips, with low commissions, ensuring cost-effective trading while maintaining high-quality execution. Traders benefit from affordable access to global markets without sacrificing speed or reliability.

Minimum Deposit and Account Types

Admirals offers three primary account types designed to suit different trading styles and investment goals:

-

Trade.MT5: A versatile account for CFD trading across forex, indices, commodities, and more.

-

Invest.MT5: Perfect for investors looking to access thousands of stocks and ETFs with direct ownership.

-

Zero.MT5: Built for active traders and scalpers with ultra-tight spreads starting from 0.0 pips and low commission fees.

All accounts come with flexible leverage and transparent conditions, making them suitable for both beginners and professionals.

Islamic Forex Account

For Muslim traders, Admirals provides a swap-free Islamic Forex Account based on the Trade.MT5 platform. It offers fast execution, tight spreads, and zero swap charges across multiple CFD instruments, ensuring compliance with Sharia principles.

Demo Account

The Admirals Demo Account mirrors live market conditions with virtual funds, allowing traders to practise risk-free. It’s an excellent tool for beginners learning the basics, or experienced traders testing new strategies on the MetaTrader 5 platform from any device.

Safety and Security

Admirals places strong emphasis on client protection and fund safety. Key measures include:

-

Regulation by multiple top-tier authorities.

-

Segregated client accounts for added security.

-

Insurance coverage and fraud protection initiatives.

These safeguards ensure traders can operate with confidence and peace of mind.

Trading Platforms

Admirals supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), trusted by millions of traders worldwide.

-

MT4: A simple yet powerful platform, ideal for beginners.

-

MT5: Advanced functionality with additional order types, indicators, and asset classes for experienced traders.

The Admirals Mobile App

Developed in-house, the Admirals Mobile App offers real-time trading, secure account management, and quick switching between demo and live accounts. With full platform functionality in your pocket, traders can access markets instantly from anywhere.

Markets Available for Trade

Admirals provides access to a diverse range of over 4,000 instruments, including:

-

Forex pairs (majors, minors, and exotics)

-

Stock CFDs and ETFs

-

Global indices

-

Commodities (energy and precious metals)

-

Bonds

This wide range supports portfolio diversification and flexible trading strategies.

Deposit and Withdrawal

Admirals offers a user-friendly funding system with multiple methods for deposits and withdrawals. The broker charges zero deposit fees, and transactions are processed quickly, giving traders clear and cost-effective fund management.

Admirals Wallet

The Admirals Wallet is a centralized tool for storing, exchanging, and managing trading funds. Supporting up to 20 currencies and even gold investing, it allows instant transfers and simplifies financial management across Admirals’ platforms.

Partnership Programmes

Admirals extends its reach through three partnership models:

-

Introducing Business Partner

-

Affiliate Program

-

White Label solutions

Each program offers transparent earnings, multilingual support, and strong marketing resources, making them attractive collaboration opportunities.

Education and Resources

Admirals stands out with its comprehensive education hub, providing:

-

On-demand articles and guides

-

Free live webinars with expert insights

-

Interactive learning tools for beginners

This strong educational focus makes Admirals a great choice for traders seeking to build knowledge and confidence before trading live.

In Conclusion

Our Admiral Markets review highlights that this broker offers a wide range of valuable features for traders of all levels. With a strong trust rating and consistently positive user feedback, Admirals has built a reputation for reliability. The variety of account types ensures that every trader—from beginners to professionals—can find an option that aligns with their trading style and strategies.